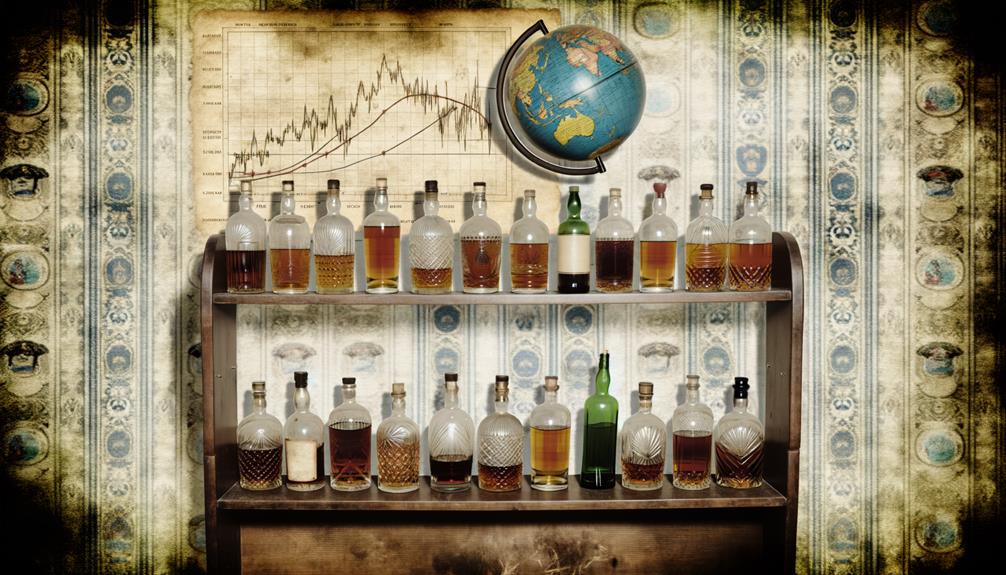

Do you know how a top-notch cook fills their kitchen with various ingredients? Well, that’s how I’ve approached my whisky collection, gathering bottles from all corners of the earth. Let’s face it: variety makes life interesting, and that’s true when it comes to whisky. Whether the smoky single malts from Scotland or the perfectly balanced blends from Japan, each bottle tells its own story. They’re like postcards from the places they’re made, showing off the unique qualities of local grains, waters, and aging methods. But there’s more to a whisky collection than just exploring the world through taste. It can also be a savvy investment that grows in value over time, especially if you play your cards right. So, where’s the best place to begin, you ask?

Understand Whisky Varieties

Whisky is a fascinating subject, offering an impressive range of types – from single malt to blended, bourbon to rye. Each variety is unique in its production methods, flavour characteristics, and how its place of origin influences it. Knowing these whisky types is a great way to diversify and enrich your whisky collection, and I’m here to help you on this journey.

Consider single malt, for example. It’s the pure creation of a single distillery, often reflecting its specific region. As we journey from the peaty malts of Scotland’s Islay to Ireland’s smooth, triple-distilled whiskies and then to the powerful bourbons of Kentucky, we learn that each bottle in our whisky collection narrates a tale of location, tradition, and craftsmanship.

Production methods are also key. Different distillation equipment, like pot stills, column stills, or finishing casks, contribute varying notes to the flavour. These subtle differences – whether smoky and peaty or sweet and floral – make our whisky collection so varied and interesting.

Whisky Selection and Diversification

Diving into the world of whisky collection and variety, it’s essential to remember that mitigating risk is key, similar to any investment. This is where having a diverse array of bottles, each with its unique worth and potential for growth, comes into the picture. Cultivating a varied whisky collection is a skill that whisky investors need to excel in the whisky market.

Here are three main points to bear in mind:

- Be choosy in your whisky choices. Consider more than just the brand; consider aspects such as age, scarcity, and special edition releases.

- Make sure your whisky is stored properly. Please keep it away from sunlight and limit exposure to oxygen to maintain its quality and worth.

- Regularly assess your collection. Keep an eye on market trends, make sure your collection is insured, and maintain detailed records.

Variety is not only about possessing different bottles; it’s about grasping the inherent worth each bottle contributes to your collection. As we go through this experience together, we are not merely whisky investors but enthusiastic keepers of a rich, liquid history. And that’s a group we all are a part of.

Whisky Investment Basics

The nuts and bolts of investing in whisky are vital if you want to unlock the full potential of your collection. We’ll start by acknowledging that whisky can be a practical countermeasure to inflation, given its potential to increase in value over time. But it’s not simply about snapping up any old bottle – it’s about carefully assembling a broad mix of whiskies that maintain their value and may even appreciate.

What should you be thinking about? Factors like age, rarity, brand standing, and market fluctuations. These elements are the backbone of whisky investment. Check out this straightforward table:

| Aspect | Importance | Example |

|---|---|---|

| Age | Whiskies that have aged more can be more valuable | Scotch aged 18 years |

| Rarity | Limited edition bottles could be appreciated quicker | Unique release of single malt |

| Brand | Brands with a solid reputation may provide stability | Well-known distilleries |

| Market Trends | Keeping an eye on trends could boost returns | The rise in popularity of peated whisky |

It’s also crucial to store your whisky correctly. Factors like temperature, humidity, and exposure to oxygen can impact the quality of your whisky. Remember that a poorly stored bottle might decrease the value of your investment.

Exploring Global Whisky Markets

Delving into the world of whisky can be a fun and rewarding experience. Don’t limit yourself to local options alone. It’s a real joy to learn about whiskies from all over the globe, each with its distinct distilleries and taste nuances. It’s like embarking on a taste adventure, exploring the spirit and the tales of culture, tradition, and craftsmanship encapsulated in each bottle.

As you embark on this global whisky journey, let’s consider three regions that are worth investigating:

- Scotland: This region is famous for its Scotch whiskies. The Scottish whisky market is a treasure trove of rich history and diverse flavours, ranging from the smooth Speyside to the smoky Islay malts.

- Irish whiskey is becoming increasingly popular, thanks to its triple distillation process that ensures smoothness. Brands like Jameson and Redbreast are making waves and are worth checking out.

- Japan: Japanese whiskies are known for their meticulous craftsmanship and unique flavour profile that marries tradition with innovation.

Whisky Collection Maintenance and Growth

Building and taking care of a whisky collection isn’t just about stacking bottles together; it’s an art form that needs a keen eye and an experienced palate. It’s about understanding whisky not just as a luxury item but also as an alternative investment. As someone who loves collecting whisky, I’ve come to appreciate the need to choose bottles that taste great and have a proven history of increasing value.

Picking the right whiskies for your collection can seem like a tall order, given the sheer variety. However, a good strategy I’ve found is to focus on a balance between well-known distilleries and rising stars in the industry, ensuring a well-rounded collection. I’m always looking for unique whiskies that show the real depth of flavour and high-quality craftsmanship.

Staying educated about the market and staying in touch with new trends is also crucial. This knowledge will guide you in making smart decisions to grow your collection. Keep in mind that creating a diverse whisky collection is a long-term investment. The goal isn’t just to get quick returns but to nurture a collection that increases in value over time and provides genuine enjoyment. This careful and considered approach to whisky collecting will make you feel right at home in this exclusive yet friendly community of whisky lovers.

Frequently Asked Questions

How Do You Build a Diversified Portfolio?

Let’s chat about creating an investment portfolio with many assets. The key is to balance different types of investments. Regularly checking in and tweaking your portfolio based on what’s happening in the market is essential. Remember, a diverse portfolio is about reducing the risk and taking full advantage of potential profits.

What Is a Good Diversified Portfolio?

I believe a well-rounded financial portfolio is like an array of investment opportunities. It’s a harmonious mix of assets such as stocks, bonds, real estate, and commodities. Think of it as a well-stocked pantry for your financial well-being. It’s not simply about having a lot of different things but about having the right balance to help secure your financial future.

What Percentage of a Portfolio Is Diversified?

The exact percentage of a portfolio that should be diversified isn’t set in stone. It boils down to individual risk appetite and financial objectives. However, as a rule of thumb, I’d recommend diversifying around 70-90% of your portfolio. This approach can help strike a healthy balance between risk and potential profit.

Can You Make Money Investing in Whisky?

Sure, there’s an opportunity to profit from whisky investments. The value of whisky can grow over time, providing a return on your investment. Additionally, its liquid nature ensures you can easily convert your investment into cash when needed. By having a diverse collection, I can lessen the chances of loss, making this a potentially rewarding investment.